Frequently Asked Questions

Here is a list of the most common questions we receive, have a look through, if you need more clarification or want to work with us, please contact us anytime!

What is a financial planner?

We don’t know. And you don’t either. That’s one of the problems with the financial planning industry in this country. The term isn’t regulated, so a financial planner can be a mutual fund salesperson, an insurance agent or a fee-only, advice-only Certified Financial Planner (CFP). Quebec is the only province that requires any training for someone to call themselves a financial planner.

That aside, a financial planner is someone who helps clients to manage their personal finances.

FP Canada – the regulatory body for CFPs like us – says that a financial planner is “an appropriately qualified professional [that] has the ability to safeguard and enhance your financial and overall well-being, both today and in the future.”

What is a fee-only financial planner?

It is estimated there are 150 financial planners (individuals, not companies) providing fee-only, advice-only financial planning in Canada. In contrast, there are 18,000 Certified Financial Planners, 25,000 financial planners and 90,000 financial advisers in Canada.

That means about 1/6 of 1% of this country’s financial advisers provide fee-only, advice-only financial planning.

Even less are completely independent, selling only their advice (no product sales either) and even less still have obtained the extensive educational training to become Certified Financial Planners.

What is the difference between fee-only, fee-based, fee-for-service and advice-only?

Fee-only, advice-only financial planning keeps advice and potential products separate, so many clients who work with a fee-only, advice-only financial planner will also have a separate investment adviser or insurance agent.

Lots of fee-based investment advisers use the term fee-only and fee-based interchangeably, which confuses consumers. There has been lots of positive media about fee-only, so everyone seems to be gravitating towards the terminology to capitalize upon this.

So if someone says they’re fee-only, you have to clarify. That’s why we like the term advice-only so we can clarify we’re not investment advisers charging a fee as a percentage of your investments.

Fee-for-service and advice-only mean the same thing.

We’re hoping the regulators take steps to regulate terms like this within the financial industry so that everyone understands what they’re getting into when they contact a financial adviser. Fingers crossed.

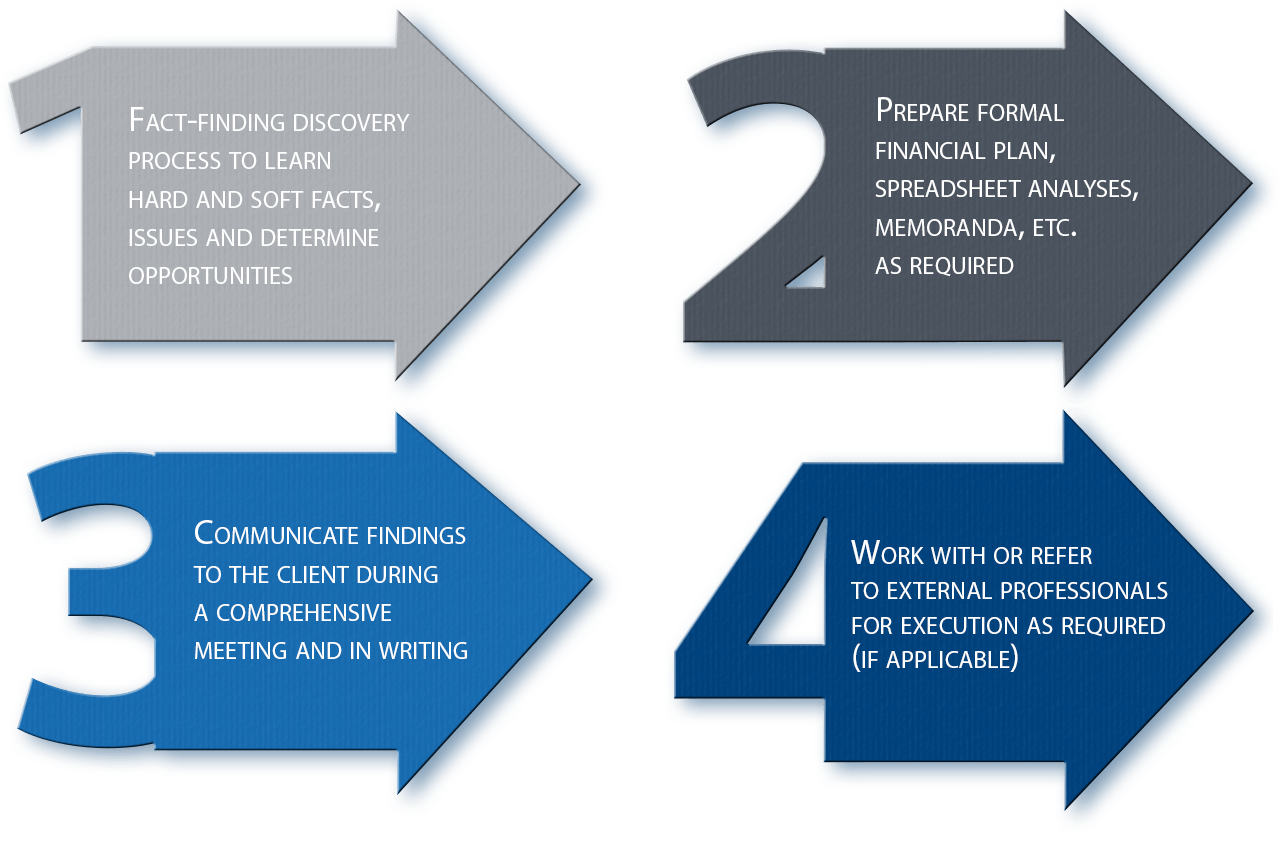

What is our process?

True financial planning is a process, not a product. After an introductory call to determine if and how we can help, our clients complete a questionnaire and provide a list of supplementary data before we put together a comprehensive financial plan that includes:

Why work with a fee-only financial planner?

Objectivity is the name of the game, which is important in a global financial market that can be fraught with conflicts of interest.

What is a financial plan?

How much do you need to save each week, each month, each year and ultimately, how much do you need to have to retire by a certain age? Should those savings be allocated to debt repayment, employer RRSP / pension plan, personal RRSP, spousal RRSP, children’s RESP, TFSA? These are just a few of the typical choices.

What’s your investment strategy? Have you addressed areas such as asset allocation, product selection, tax efficiency, fees, estate implications and performance? Are you aware of the current investment options in the Canadian marketplace?

Is your financial plan tax-efficient, or are there things you should be doing differently, either individually or as a family?

Most importantly, what happens if you become sick, injured or disabled, or worse, if you die? Will your family’s financial plan still be on track?

A financial plan is a comprehensive projection over the long-term that identifies and projects your income, expenses, assets and liabilities and how these four areas come together on an annual basis for the rest of your life. It can be used to make decisions for either the short-run or the long-run. It’s chock full of numbers if you like the detail, but also has charts and graphs if you’re a visual learner.

What is the difference between a retirement plan and a financial plan?

A retirement plan determines the level of savings required to retire at a specific age and an optimization of your retirement cash flow.

Our retirement plans include sensitivity analysis regarding spending and rate of return as well as a 2-hour meeting to review your plan.

A financial plan is more in depth. In addition to a retirement plan, which is a component of a comprehensive financial plan, we will review your investments, tax returns, wills and insurance policies vis-à-vis your retirement plan and deliver our recommendations during a second 2-hour meeting.

We provide an analysis of your investment portfolio with a particular focus on investment strategies, asset allocation, product selection, tax efficiency, fees, estate implications and performance.

We will discuss current investment options in the Canadian marketplace, including third-party advisers and firms. Since we do not sell investments, our advice is objective. We do not receive referral fees or any other compensation from third parties.

Not everyone needs a retirement plan. That’s why we also provide more general financial consultations. Not everyone will get all their answers from a retirement plan. That’s why we provide more comprehensive financial plans.

That’s the beauty of working with a fee-only, advice-only financial planner. You’re paying a fee for service and it’s up to you to decide – with input from us if you’d like – what service is most suited to you.

What if I just have a few questions and don't need a full plan?

Areas of interest may include financial planning, retirement planning, investments, pensions, debt, budgeting, insurance, taxes or estate planning.

Financial consultations include some basic data collection from you in advance of a meeting, a meeting in-person or via phone or Skype, as well as our written recommendations so that you can then take action on your own.

If you decide after a consultation that you need or want a full retirement or financial plan, we offer a discount based on the initial data collection in that consultation.

What services do you offer?

– retirement planning

– investment strategy

– tax planning

– tax preparation (T1 personal and T3 trust tax returns in-house and T2 corporate tax returns outsourced)

– insurance needs

– estate planning

– financial planning for Canadian expats

– paraplanning (the planner’s planner – advisers outsource the preparation of financial plans and other services to specialists like us)

– employee financial planning (companies offer our services as a perk for their senior executives or financial seminars for the broader employee group)

– other services as required

What are your fees?

Our fees are generally flat project fees or annual fees, but we also offer financial planning consultations starting at $1,500, as well as hourly options when appropriate.

A detailed retirement plan is generally $2,500 to $3,500 for a single client, $3,000 to $4,000 for a couple, and $4,500 to $5,500 for an incorporated client, but these can range lower or higher depending on the situation.

A more comprehensive financial plan that includes a retirement plan, but also looks in-depth at areas like investments, insurance, tax, and estate planning, may range from $4,000 to $10,000 or more depending on a client’s goals, circumstances, and complexity.

All fees are exclusive of applicable sales tax. We can provide a written quote based on an initial no-obligation phone or Zoom meeting.

Can you provide us with references?

Sure we can.

You can start by checking out our testimonials page.

We are Certified Financial Planners (CFPs). Our governing body, the FP Canada, “ensures those it certifies . . . meet appropriate standards of competence and professionalism through rigorous requirements of education, examination, experience and ethics.”

If you’d like us to provide references from satisfied clients, just ask. Our planners have worked with thousands of clients during their careers.

What's the return on investment from working with a fee-only, advice-only financial adviser?

Costs depend on complexity and whether or not you would like to meet with an adviser to review or implement the plan. Some people just want a one-time meeting, sort of like going to the doctor for a check-up. Others work with us on an ongoing basis with regular meetings and potentially tax return preparation for them and their family. All of these things will impact the pricing of the service.

Do you have any minimums?

Our clients have a net worth ranging from zero to several million dollars.

Most of our clients are wealthier than the average Canadian and many are high net worth investors. If not, they aspire to be – and we aspire to help them get there or stay there.

Do you work with clients outside of Toronto?

We work with clients across Canada and the world via Skype, phone and email.

In this day and age, location is not an issue and we have clients from Toronto to Vancouver to Dubai to Singapore – literally.

Do I need financial planning every year?

Some people engage us year in and year out and pay an annual retainer fee. Some have worked with us for 10+ years and may work with us forever. But not everyone needs financial planning every year.

Some people hire us once and we have a specific mandate and never see them again. Some people engage us every few years or as life circumstances change.

Value is in the eye of the beholder. We want to be an investment and you’re the investor. Use us as you see fit.

Do some people benefit from having us on call and being forced to sit down at least once a year to talk money? Absolutely! You may – or may not – be one of them.

What sets Objective Financial Partners apart from the competition?

Beyond that, it is estimated there are 150 financial planners (individuals, not companies) providing fee-only, advice-only financial planning in Canada, though unlike us, some of these individuals do also sell products. We sell no products whatsoever. Our sole purpose is unbiased, objective financial, tax and estate planning advice.

There are 18,000 Certified Financial Planners, 25,000 financial planners and 90,000 financial advisers in Canada. That means about 1/6 of 1% of Canada’s financial advisers provide fee-only, advice-only financial planning. Even less are completely independent, selling only their advice and even less again are Certified Financial Planners.

Beyond that, we use state of the art financial planning software. It is not the easiest or the quickest software in the marketplace because we focus on accuracy, thoroughness and quality when we work with our clients.

Our planners are very experienced. Each of them has at least 15 years of experience.

Objective Financial Partners wants to be the best fee-only financial planner, not only in Toronto but across all of Canada.

What can you do that my investment adviser or accountant isn't already doing?

We are experts and putting together all of the pieces of the puzzle. Your tax accountant probably doesn’t have a lot of expertise in retirement modelling. It’s the main thing we do. And when they give you advice, is it based on a thorough assessment of your situation, or is it a canned, generic, rule of thumb response?

Investment advisers are not fiduciaries and they are not required to put your best interests first. There is a best-interest standard in Canada, but it’s a very loose standard and sometimes, what’s in your investment adviser’s best interest trumps what’s in your best interest.

There are some excellent investment advisers in Canada who put their clients first and who are very well-versed in financial planning. Some are not and few are as proficient in comprehensive financial planning as us.

We are complementary to your other advisers. And they are complementary to us. Most of our clients would say that we provide advice that they have never received before from their other financial advisers. And that’s our goal – to surpass your expectations and provide a new take on your personal finances.

What is your investment philosophy?

We don’t discriminate. There is no one best way to invest your money. There are best practices focused on asset allocation, tax efficiency, fair and reasonable fees, etc. that we like to consider.

We can help evaluate the pros and cons of what you’re doing currently and assist you in exploring alternatives. But we don’t get paid any differently depending on what you choose.

Some of our clients are do-it-yourself (DIY) investors and others work with investment advisers of all different kinds.

We’re always up-to-date on the investment industry and its changing landscape.

Do you provide fee-only investment advice?

We can talk about investment options within the Canadian marketplace including do-it-yourself (DIY); robo-advisers / online advisers; transactional / commission-based stock brokers; discretionary fee-based portfolio managers; private market / exempt market dealers; real estate property managers; and so on.

Since we do not sell investments, our advice is objective. We do not receive referral fees or any other compensation from third parties. Some fee-only financial planners DO receive referral fees and other compensation from third parties. As such, their advice may not be truly objective.

There is no such thing as a “fee-only investment advisor” who can give you advice on your investments without an investment license and without managing your investments. So anyone who tells you otherwise is unlicensed and should not be providing you with investment advice.

What kind of questions can you help me answer?

How much do I need to retire by a certain age?

How much do I need to save each month to achieve my goals?

How much can I afford to spend in retirement?

How can I maximize my government benefits like CPP and OAS?

What options should I choose for my defined benefit (DB) pension?

Should I take a lump-sum commuted value payout from my pension or a deferred monthly benefit?

Should I save using an RRSP or TFSA?

When should I start RRSP withdrawals?

How do I split income in retirement?

How do I create an income in retirement?

Investments

What types of investment accounts should I have?

How much should I contribute to different accounts?

Should I save in my name or my spouse’s name?

What types of accounts should I open for my kids?

Should my investment accounts be joint?

Should I pay down debt or invest?

What kind of investments can I have in a corporation?

Should I buy a rental property?

What is my risk tolerance?

Is my asset allocation appropriate?

Has my investment performance beat the markets?

Are my investment fees reasonable?

Should I be a DIY investor?

Is my investment advisor a good one?

Tax Planning

How do I pay less tax today?

How do I pay less tax over my lifetime?

How do I split income with family members?

How do I pay less tax on my investments?

How do I fund my retirement in the most tax efficient manner?

How do I reduce capital gains tax on my cottage?

Should I take a severance or salary continuation?

Should I set up a corporation?

Should I pay myself a salary or withdraw dividends from my corporation?

Should I set up a holding company?

Should I establish a family trust?

Should I issue shares of my company to my children?

Should I wind up my corporation?

How do I plan for the sale of my business?

Insurance

Do I have enough life insurance?

Do I have the right kind of life insurance?

Do I need disability insurance?

Do I need critical illness insurance?

Should I buy health insurance?

Should I cancel my insurance policy?

What type of insurance do I need in retirement?

Should I buy insurance for my kids?

Estate Planning

Should I have a will?

What assets will pass through my will?

What beneficiaries should I name?

Should I own assets jointly?

Should I transfer assets to my children now or in the future?

How do I make a plan for the family cottage?

How do I make a plan for the family business?

Should I consider an estate freeze?

Should I add my name to a parent’s account?

How do I minimize probate fees?

Should I worry about U.S. estate tax?

What is a power attorney for property?

What is a power of attorney for personal care?

Should I establish a trust?

How do I maximize my charitable giving?

Where did the name “Objective Financial Partners” originate?

We liked the term “objective” because it served a dual purpose.

We are objective because we sell no products whatsoever. Our sole purpose is unbiased, objective financial, tax and estate planning advice.

Financial planning is also about establishing objectives and we aim to help our clients achieve them.

“Financial” is obvious, because it’s what we live and breathe.

“Partners” is also multi-faceted.

We partner with our clients to help achieve their goals.

We partner with third parties within the financial industry to together provide comprehensive financial advice for those who need third party specialists or financial products.

And we are like-minded partners of financial planners focused on helping you achieve all your financial objectives.

We are Objective Financial Partners.

The purpose of this meeting is to understand your specific needs to determine if and how we can help. We then provide a quote for our services to be detailed in a written engagement letter that acts as our contract to you. Please note we cannot provide advice to you during this introductory meeting.

We work with many self-directed DIY investors. That said, we cannot provide investment recommendations for the purchase or sale of specific securities, nor can other fee-only/advice-only financial planners in Canada who are not licensed to manage your investments.

Please note our minimum consultation fee is $1,500 plus applicable sales tax. If you provide some information below and request it from us, we can provide a rough estimate on pricing prior to an introductory meeting.

Objective Financial Partners Inc.

675 Cochrane Drive

East Tower, 6th Floor

Markham, Ontario

L3R 0B8

T. 416.691.8471

Toll Free. 1.855.691.8471

Copyright © 2018 |Objective Financial Partners Inc. | All rights reserved.

We don't sell investments, so we're not going to tell you which stocks to buy and sell. However, we can build you a comprehensive and truly objective financial plan.

Please send email inquiries to info@objectivecfp.com