You could have money trauma.

Like all trauma, it’s different for everyone. At the very least, you may have some emotional wounding, cognitive distortions, or negative feelings around money.

I’ll explore these themes more deeply in separate articles. Suffice to say for now that there is trauma around money.

Some people scoff at the idea of trauma in general, or specifically money trauma. It does sound serious, after all – and most of us feel we’ve turned out okay. As a definition, trauma is “a deeply distressing or disturbing experience”. Financial or money trauma though is “the emotional, cognitive, relational, and physical symptoms triggered by significant financial stressors.”

Here are a few examples of money trauma:

- Housing insecurity (very common today).

- The North American culture of individualism vs. collectivism.

- Experiences of money scarcity – both childhood and adulthood.

- Caregivers that valued work more than family time.

- Caregivers who taught that money success was the only worthy metric of success.

- And so many more.

Like all unresolved trauma, it can lead to survival coping behaviours. Sometimes termed “maladaptive”, survival behaviours mean “strategies or behaviours that are ineffective, harmful, or counterproductive in dealing with stress, adversity, or difficult situations“.

A few examples, but there are so many more:

- Insufficient boundaries around money – undercharging or underearning.

- Restricting spending to feel in control.

- Overspending to self-soothe.

The examples in this article will only be discussing the last behaviour, overspending – but there’s incredible things to learn about the brain, stress responses, and how to improve maladaptive money behaviours for everyone.

All these coping behaviours are very common and very normal. They are reasonable reactions to real trauma or wounding and are virtually unavoidable when you’re stressed or anxious. That’s normal, and it all has to do with how your brain is wired.

The Connection Between Your Brain and Overspending

Your brain is obviously incredibly complex, but when we’re trying to understand how it works in a practical sense, it can help to reduce the brain to 3 main areas: the frontal lobes, the limbic system, and the brainstem. Front, middle, back.

Other terms you’ll be familiar with are the “homo sapiens brain”, “mammalian brain”, and “reptilian brain”.

The frontal lobes (homo sapiens brain) are responsible for conscious thought, intellectual & executive functioning, and self awareness. This is the part of your brain that’s helping you make financial decisions you’re happy with: like contributing to your retirement account instead of buying a new mountain bike or saving up to buy that truck instead of financing the whole thing.

The brainstem (reptilian brain) is responsible for your instinctual responses.

When you are stressed (think fight-flight-freeze-fawn), your brain perceives risk and your frontal lobes shut down. This makes perfect sense – your brain is trying to help you survive what your brain perceives as a life-or-death situation. Your brain is ensuring your instinctual responses are online, and your thinking brain won’t get in the way.

To clarify, and emphasize: when you are emotionally stressed, the part of your brain that can make conscious decisions shuts down. You’re physiologically unable to make rational decisions.

when you are emotionally stressed, the part of your brain that can make conscious decisions shuts down.

If you’re an overspender, maybe you soothe tough emotions or stress by impulse spending or just spending more than you wanted to. Once those frontal lobes come back online, you might find yourself regretting it.

Hopefully this knowledge can take the shame out of the behaviour. It’s normal, expected, reasonable and a biological response. But what can we do about it? Does this mean we’re doomed to act out the same behaviours over and over?

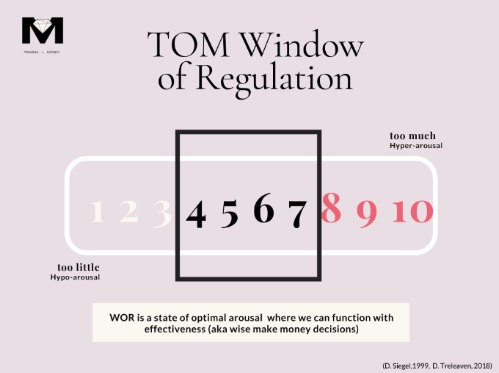

Not necessarily. This is where I can introduce the Window of Tolerance or Window of Regulation.

Window of Tolerance

Our daily life is stressful. It’s fast-paced, there’s tons of stimulus and pressure to succeed. If we’re acting out money behaviours that we regret, that can contribute to stress and overwhelm. It makes sense that you would have a recurring cycle of stress that causes survival money behaviours…. That causes more stress.

If you’re in a state of hyperarousal (think fight-or-flight, high energy, anger, overwhelm, anxiety), or hypoarousal (shutdown, depression, freezing, withdrawing) you’re not thinking rationally.

The Window of Tolerance or Window of Regulation is an idea developed by Dan Siegel, MD. If you can operate within this Window, you’re grounded, present, and able to emotionally self regulate.

According to Dr. Janina Fisher, spending (or restricting) money can create a “false window of tolerance” that is really contributing to more issues.

Credit to Trauma of Money for the above image – reproduced with permission.

How can you get back into this Window from a state of hyper or hypoarousal, and start improving your money behaviours?

Regulation and Controlling your Desire to Overspend

To support yourself and your nervous system, you need to be completing the stress response cycle. This cycle is:

- Activation

- Mobilization

- De-activation

- Restoration

What are some ways to mobilize and de-activate? Here is an uncomprehensive list of practices that could help with regulation, taught by Andrea Gutiérrez-Glik, LCSW.

- Movement, like yoga or walking

- Drawing, journalling, art

- Religion or spirituality

- Crying, laughing, therapy

- Reading or listening to books & podcasts

- Being outside in nature

Regulation is a skill like any other and takes practice. If it’s new to you, it might be difficult for a while.

Once you’re in your WOR/WOT, you’re able to think rationally, but you still have years of habits and conditioning to deal with. if you can introduce a pause before spending, and a values-based decision, you’re much less likely to overspend.

In Psychology of Financial Planning, 2022 by Brad Klontz, Charles Chaffin & Ted Klontz, they recommend the following strategies:

- Delay making an important financial decision for at least 24 hours.

- Ask yourself questions before making a purchase, like “can I afford it?”, “where will I put it?” and “how will I feel about this purchase tomorrow?”.

- I’ll add to this, with “does this purchase support my goal of ___?” and “how will I feel about this purchase in a month?”.

- Consult with your financial planner before making a big financial decision.

As for myself, I recommend also introducing a pause into everyday spending that can add up to overspending over time. You can ask yourself the same thing here: “does this purchase support my goal of ___?”.

There’s a lot more to all of this than can be discussed in this short article. You can reach out to me (Hannah McVean, CFP®, CIM®) if you want to review these ideas further.

The ideas and teachings in this article are interpreted based on the teachings of Trauma of Money and Andrea Gutiérrez-Glik, LCSW.